TSMC Loses U.S. Export Privilege, Escalating Pressure on China

TSMC, the world’s largest semiconductor manufacturer, is no longer granted a special U.S. export privilege for shipping chip-making equipment to its Nanjing factory in China. The validated end-user status will expire on December 31, 2025. After that date, TSMC must obtain export licenses for such equipment. This move reflects the U.S.’s tightening grip on semiconductor exports to China amidst escalating trade tensions.

This export change is part of a broader U.S. strategy to restrict advanced chip technology from reaching China. Companies like Samsung and SK Hynix have already lost similar privileges. In August 2025, former President Trump implemented a 100% tariff on non-U.S.-manufactured chips unless the manufacturer built a local factory—a clear signal to boost domestic chip production.

Minimal Impact on Revenue, but Strategic to Watch

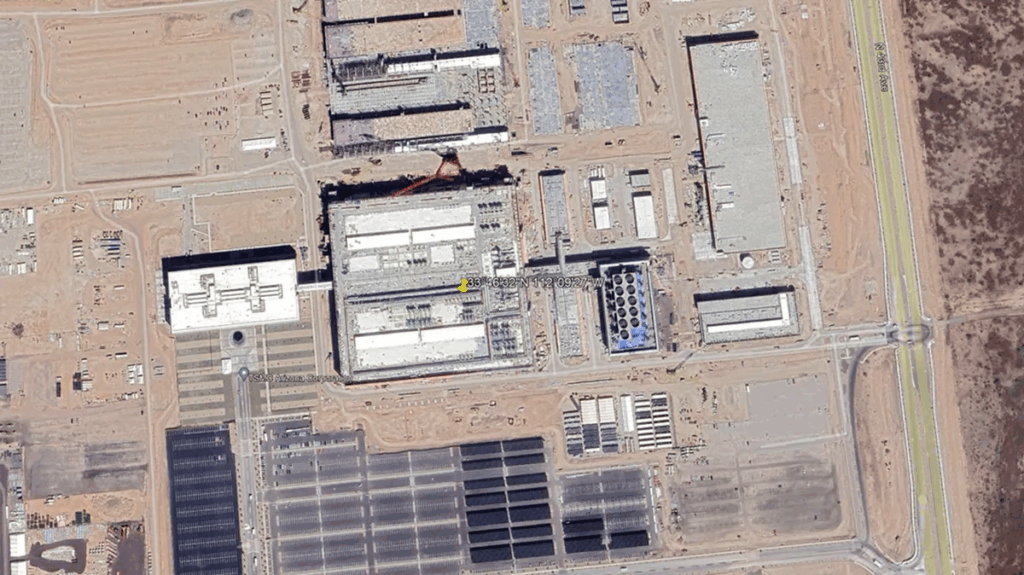

TSMC’s Nanjing plant primarily makes 16-nanometer chips and generates just 2.4% of the company’s total revenue. With a 70% foundry market share and recent quarterly revenue hitting $30.24 billion, the financial hit might not be drastic. TSMC intends to keep its operations running smoothly. Most of its advanced chip production remains based in Taiwan, while U.S. facilities are ramping up capacity.

U.S. Pushes Homegrown Chip Production

In June 2025, the U.S. Department of Commerce revealed that Micron—America’s sole advanced memory manufacturer—plans to invest $200 billion to expand production. This aligns with national priorities to reduce reliance on Chinese supply chains. Despite U.S. courts finding some tariffs unconstitutional in May and August 2025, the penalties remain enforced.

Broader Industry Ripples Ahead

These semiconductor export restrictions threaten to raise hardware prices globally, especially in consumer tech and gaming that depend on older manufacturing processes. Shares of Samsung and SK Hynix fell sharply in response, revealing widespread market anxiety.

As U.S.-China trade friction intensifies, semiconductor companies must adapt to stricter controls. The resulting shifts in production locations and increased costs could reshape the global tech landscape. Nevertheless, TSMC’s strong base in Taiwan and U.S. investments offer a strategic buffer for long-term resilience.

Final Thought

The U.S. move to revoke TSMC’s export passport to China underscores how geopolitical strategy now rivals technological competition. For Southeast Asia—where the gaming, hardware, and tech ecosystems rely heavily on semiconductor supply—this signals a time to anticipate tighter shortages and price shifts. TSMC’s pivot to stabilise operations and double down on U.S. production reflects both the fragility and adaptability of the global chip market.

origin

pcgame