Japanese Politician Exposes Credit Card Companies’ Hidden Game Censorship

Zenko Kurishita reveals how Visa and Mastercard use ambiguity to control content

In recent years, the issue of game censorship, especially for titles with adult content, has gained increasing attention in Japan and abroad. Zenko Kurishita, a former member of Japan’s House of Representatives known for defending freedom of expression, spoke with gaming outlet Denfaminicogamer to analyze how major credit card companies like Visa and Mastercard quietly pressure developers and platforms while intentionally making accountability invisible.

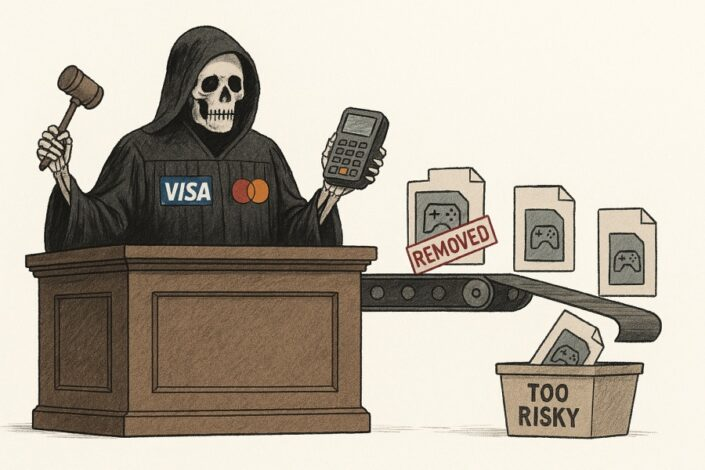

Kurishita explained that this mechanism began tightening in 2022, starting with adult content platforms like DLsite before expanding to global platforms such as Steam and Itch.io. According to him, credit card companies often use vague communication methods. Platforms rarely receive a clear explanation of which specific content violates rules. Instead, they are abruptly told things like, “Starting next week, you cannot use our payment services.”

What makes the situation worse is that these messages usually do not come directly from Visa or Mastercard, but through intermediaries such as Acquirers or Payment Processors. This layered system blurs responsibility to the point that when games are delisted or censored, no one can be held directly accountable, even though the rules originate from these financial giants.

Kurishita believes this is a deliberate strategy to disperse responsibility. By hiding behind intermediaries, credit card companies avoid direct backlash while still shaping the market to their own rules. He warns that the most dangerous factor is “public ignorance.” As long as players and society remain unaware, these corporations can maintain power and influence without resistance.

As a solution, Kurishita suggests raising public awareness and diversifying payment channels to reduce reliance on Visa and Mastercard. Japan, in particular, heavily depends on foreign-based payment infrastructure. Introducing more domestic or alternative payment systems would weaken the grip of major credit card companies and prevent them from applying unchecked pressure.